The Software as a Service (SaaS) market continues to flourish. It’s underpinned by the ever-expanding digital transformation drive across various industries globally. Statista reports that end-user spending will hit $232 billion next year, an 8x growth rate since 2015.

However, it’s a good idea to acquaint yourself with the most recent benchmarks and statistics. They help to give you an idea of where you’re at now and where you’d like to go in the future.

So, welcome to a comprehensive guide that unfurls the latest trends, growth trajectories, and performance markers in the SaaS realm for 2023. The idea here is to provide you with invaluable insights no matter where you are in your professional journey.

For the industry of SaaS 2023 – these are the key metrics and facts shaping the industry right now.

Table of Contents

The Global Outlook: SaaS 2023

The SaaS 2023 market is experiencing rapid growth due to several factors.

The increasing adoption of cloud technology has made implementing SaaS solutions easier and more cost-effective. This has resulted in a surge in demand for SaaS products across a wide range of industries.

SaaS companies have become increasingly adept at providing highly specialized, niche solutions tailored to specific business needs. This has further fueled the growth of the market.

As more businesses turn to cloud computing and need customized software solutions, it’s likely that the market will continue to expand.

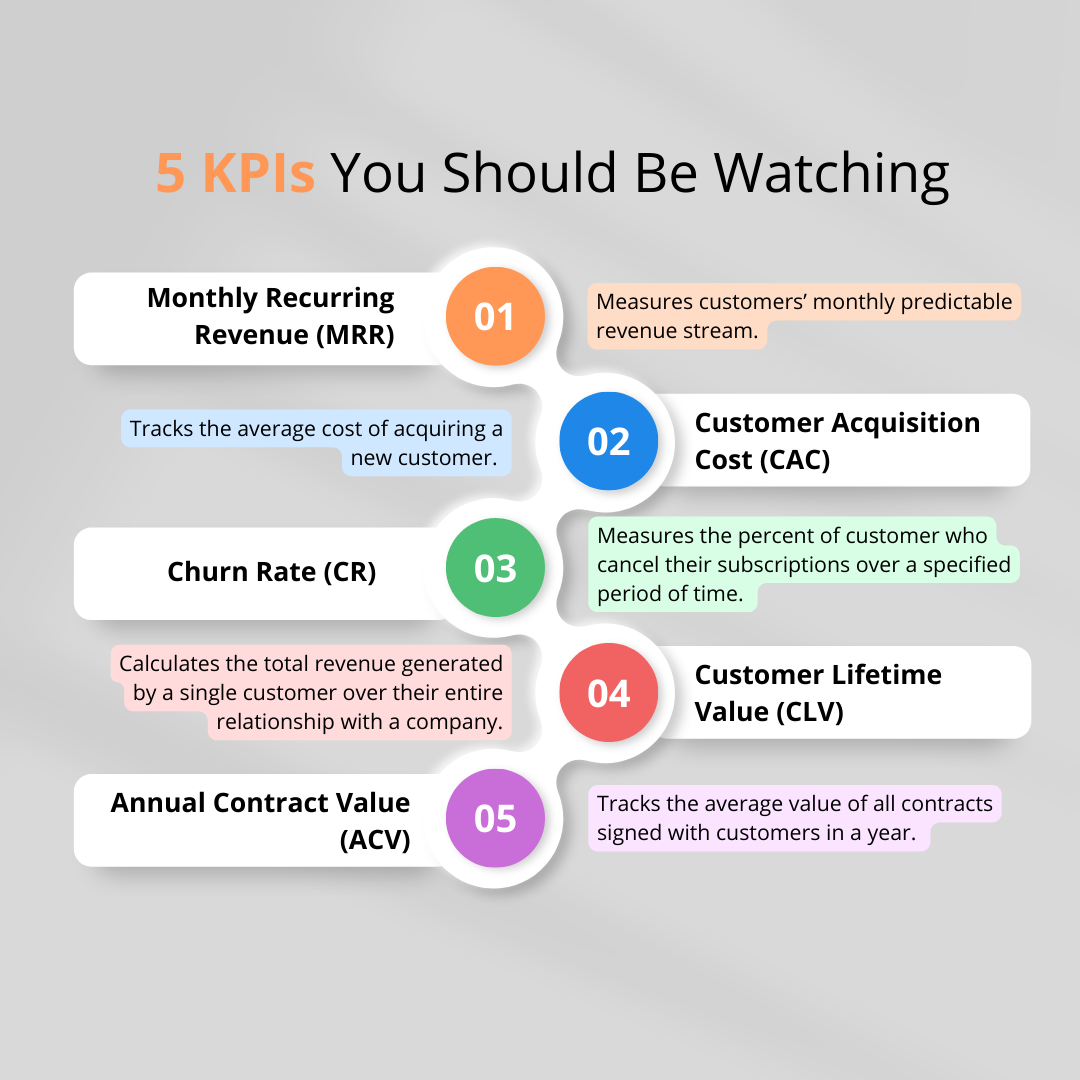

SaaS Growth Benchmarks – 5 KPIs You Should Be Watching

As the market grows and evolves, staying on top of the key performance indicators (KPIs) that track and measure a company’s success in this highly competitive industry is essential. Some of the most critical SaaS growth benchmarks for businesses in 2023 include:

Monthly Recurring Revenue (MRR)

Also known as MRR, this metric measures customers’ monthly predictable revenue stream. It provides insight into a company’s financial stability and growth potential.

Customer Acquisition Cost (CAC)

A KPI that tracks the average cost of acquiring a new customer. It’s crucial in determining the effectiveness of marketing and sales efforts.

The more customers marketing efforts bring in the door, the better your team is doing, and you know you can continue on. If this metric isn’t looking so hot, you need more testing or a new strategy.

Churn Rate

The churn rate measures the percentage of customers who cancel their subscriptions over a period. This metric also highlights how well a company retains its customer base.

One estimate found that at least 50% of SaaS licenses are going unused. This means that mediocrity is slipping through the cracks unnoticed. So, if your churn rate is exceptionally high, your product is being noticed by department heads for the wrong reasons.

Customer Lifetime Value (CLV)

CLV calculates the total revenue generated by a single customer over their entire relationship with the company.

The metric gives insights into potential revenue and profit growth. A high CLV means companies need your product. It’s essential to help them operate effectively.

Annual Contract Value (ACV)

ACV tracks the average value of all contracts signed with customers in a year. It’s an overview of a company’s revenue and growth potential.

SaaS Industry Benchmarks

Apart from the general KPIs mentioned above, tracking SaaS industry benchmarks is crucial to gaining a competitive edge. Here are some key points to keep an eye on:

- Average subscription price: This varies significantly depending on the industry. However, it’s essential to know the average price in your niche to stay competitive and ensure profitability. Small and medium companies are likely your target, as they’re spending a lot on these services. Smaller teams, smaller budgets, and a need for maximizing their time and budgets. Know your audience.

- Customer retention rate: This metric measures the percentage of customers who continue renewing their subscriptions. It’s a good look into customer satisfaction and loyalty. It’s reported that companies are wasting around $17 million a year on SaaS services. Don’t be one that gets cut to tightening budgetary concerns. Perform well, provide great customer service, and do it at a reasonable price to keep this metric where you want it.

- Time-to-value (TTV): TTV tracks how long it takes for a new customer to start seeing value from your product or service. If you have an inefficient onboarding process, this metric will highlight that.

- Gross margin: Measures the percentage of revenue that a company retains after deducting the cost of goods sold. It will give you insights into profitability and long-term sustainability.

You should be able to see some common themes at this point. Your numbers will only be as good as the quality of service you provide and at the most reasonable price possible.

The SaaS companies that are doing their best keep a close eye on their numbers. Tracking them ensures they have a great product businesses rely on for success.

SaaS Benchmarks 2023: A Geography Refresher Course

SaaS marketing statistics show significant growth rates across the globe. Some regions are showing more promising growth trajectories than others.

Regarding SaaS benchmarks 2023, North America currently holds the largest share of the global SaaS market. Followed by Europe and Asia Pacific.

However, Asia Pacific should expect to see the highest growth rate. This is due to increasing digitalization and a growing focus on cloud-based solutions in emerging economies.

Additionally, Latin America and the Middle East & Africa should expect substantial growth in the SaaS market. This is due to the increasing demand for digital transformation and cloud-based services.

Know Your Sector: SaaS Spending Benchmarks

Before launching your product, you must know who you’re launching it to, for, and why. This requires you to know your audience. Their success is your success. So you also need to believe in what they do.

We know, we know. This is the “show me the money” part of the post. Here are some important SaaS spending benchmarks:

While the SaaS market has seen widespread adoption across various industries, some sectors have been quicker to embrace cloud-based solutions than others.

The healthcare, financial services, and manufacturing industries are the most prominent adopters.

These sectors have recognized the value of SaaS in improving efficiency, streamlining processes, and reducing costs.

Other industries, such as education, retail, and government, are also expected to grow significantly as they prioritize digital transformation.

Noteworthy SaaS Businesses

The SaaS industry has a continuous influx of innovative, disruptive startups that challenge established players. They push the boundaries of what’s possible with cloud-based solutions.

It’s important to have goals in this business. Part of that is seeing what other companies are doing. How will you be different? Better? How can you build something that sets you apart from the current competition? How can you build on top of them?

Some noteworthy SaaS companies to watch include:

Intuit

You know Intuit. But you may not know the name. They are a financial services powerhouse. They own Quickbooks, Credit Karma, Turbo Tax, and Mint.

If you have any interest in finance at all, you’ve heard of their products, and you know they’re doing big things. Something you may not know – they’ve been around since 1983!

Block aka Square

Block has seen its fair share of ups and downs. But what startup hasn’t? Risk is an inherent part of business, and the biggest rewards come from taking the biggest gambles.

Block caters to everyone from large enterprises down to individual content creators. They’re the masterminds behind Cash App and offer their own suite of business service software used for credit card transactions.

Zendesk

No one comes up with a great business idea and thinks, “But what about customer service?”. It’s not pretty. It’s not sexy. It’s a war that’s fought in the trenches.

Because it’s usually an afterthought, Zendesk was able to take advantage and rise to prominence. It’s a fully customizable software that scales with your team. And because it wasn’t sexy, they were able to take almost complete control of the market with relative ease.

Splunk

One of the biggest challenges when it comes to everything internet is surrounding security. There’s a lot of exposed data out there.

What happens when you combine cloud computing, security, and analytics all in one? Splunk. Which is why they’ve become a heavy hitter in the space.

Allscripts

This is a great example of a company that decided to niche down. They asked healthcare professionals, “What do you guys need in a SaaS tool?”.

Then they went to work and released software that provided a powerful combo of clinical financial options and covered point-of-care technology.

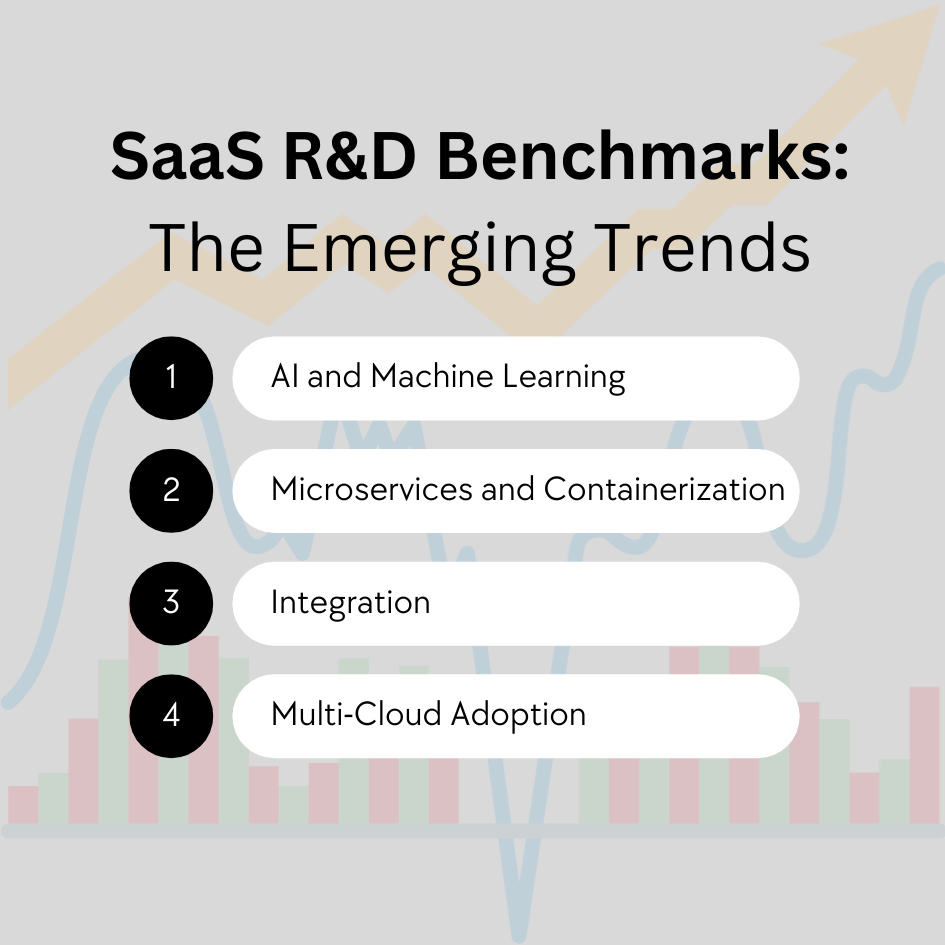

SaaS R&D Benchmarks – The Emerging Trends

As we look toward the future of SaaS, there are several emerging trends that you can expect to shape the industry in 2023 and beyond. Take some time to familiarize yourself with the SaaS R&D benchmarks so you can prepare yourself for growth. These include:

- AI and Machine Learning: With the increasing amount of data generated by SaaS applications, AI will play a crucial role in analyzing data and providing insights. It will be a factor not just on the client side but also on the business side of things as well.

- Microservices and Containerization: As companies strive for greater flexibility and scalability, the use of microservices and containerization in SaaS applications is expected to increase. Also referred to as Micro-SaaS, this is about niching down as far as your software will allow. Not just to a certain sector, but possibly even a specific audience or individual use case.

- Integration: As leading SaaS companies start to pull away from the rest of the pack, expect to see a new school of businesses building on top of existing products to help make them better.

- Multi-Cloud Adoption: Reducing costs and increasing flexibility will lead to the adoption of multiple cloud providers

Revenue Forecasts for the SaaS Industry

The SaaS industry is expected to grow rapidly in the coming years. Revenue forecasts predict a market size of just under $1 trillion by 2030.

Factors such as increasing demand for digital transformation, growing adoption of cloud-based solutions, and the emergence of new technologies will drive this growth.

As the industry continues to evolve and adapt to changing market trends, SaaS will play a crucial role in shaping the future of business operations.

Stay on top of industry benchmarks and emerging trends to become competitive in the years to come.

SaaS 2023 – Challenges Facing Industry

While SaaS is poised for significant growth in the coming years, it’s not without its challenges. SaaS 2023 – the key challenges:

- Increasing Competition: With a low barrier to entry, the SaaS market is becoming increasingly crowded. New players in the game may find getting a foothold is more of a challenge.

- Data Privacy and Security: Trust is everything in this industry. As data becomes more valuable and vulnerable, SaaS companies must prioritize data privacy and security.

- Customer Retention: With more options available, customer retention is becoming a primary consideration. Focus on providing value and building strong customer relationships to retain subscribers.

Remember, recession fears are a part of every industry. But we remain cautiously optimistic regarding startup funding in 2024.

Future Predictions: SaaS 2023 and Beyond

The industry is at an exciting juncture, poised for significant expansion and growth in SaaS 2023 and beyond. It has an increasing global footprint, adoption across various sectors, and continued innovation from startups.

The rise of AI and other points mentioned above all signal a dynamic shift in the SaaS landscape.

Simultaneously, the challenges of increased competition, data privacy, security, and customer retention are going to be what separates the amateurs from the serious companies.

This is why SaaS benchmarks 2023 are important to monitor. All of the following should be watched closely:

- SaaS growth benchmarks

- SaaS industry benchmarks

- SaaS spending benchmarks

- SaaS R&D benchmarks

Overall, the future is bright. The whole industry has a trajectory pointing to continued relevance and importance in the world of digital transformation.